13 Mar

2016

Directors & Officers

Directors and Officers (D&O) Liability Insurance protects the directors and officers of organizations (and its’ subsidiaries) against legal judgments and related defense expenses resulting from allegations of wrongful acts committed by an individual(s) in their capacity as a director(s) and/or officer(s).

Directors and officers are fiduciaries of the organizations they serve and are responsible for managing the organization. They must act with due diligence in carrying out their responsibilities and can be held personally liable if their neglect results in a loss to the organization or numerous constituents.

The larger the organization, the greater likelihood it is to sustain litigation against its directors and officers. Numerous constituents (including: stockholders, clients, government agencies, competitors, etc.) can file a claim if they feel wronged by organizations’ directors and/or officers. D&O litigation, even when it’s merit less, are a financial and emotional drain on companies.

The insurance industry has designed specific D&O policies to address the unique needs of directors and officers of each of the following by corporate structures:

- Public Companies

- Acquired / Merged / Bankrupt (Run-off Coverage)

- Private Companies

- Non-Profit Organizations

- Initial Public Offerings (IPO)

- Real Estate Investment Trusts (REITs)

- Limited and General Partnerships

- Financial Institutions (Banks, S&L’s, Investment Advisors, Insurance Companies, etc.)

Each corporate structure has unique aspects that require a specific D&O policy to match its needs. Many of these policies have underwriters that only specialize one or two of these specialized policies. It is important when submitting a prospective ‘risk’ to D&O underwriters that it is complete and presented in a professional comprehensive manner. Ask your ExecutivePerils broker which policy is right for your insured.

The largest D&O carriers do not always offer the best in price, coverage and claims handling. Many underwriters offer coverage both on an admitted and non-admitted basis. All D&O insurance is provided on a claims-made basis. Usually the only policies written on a “duty to defend” basis is Non- Profit and Private Company D&O. The other types of D&O, including Public D&O is written on a ‘reimbursement’ form. This is done so the directors and officers can choose their counsel and have great control of their defense.

Public Directors’ & Officers’ Liability

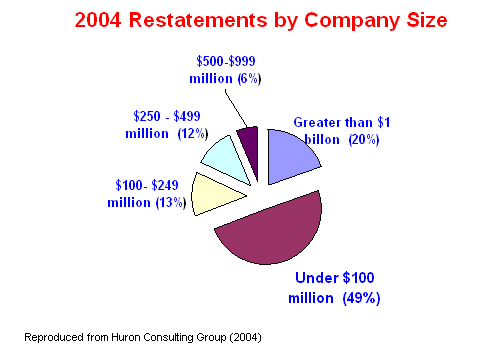

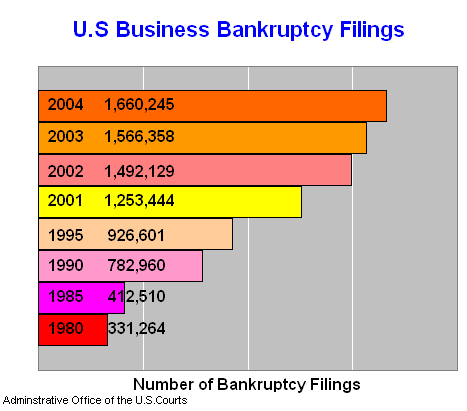

Never before has corporate America faced so many challenges. In the last few years we have seen a record number of financial restatements, bankruptcies, laddering allegations, criminal and civil action against corporate directors and officers. For a copy of the GAO report on Public Company Financial Restatements, please click here

In the last 15 years the D&O Insurance community has seen a great number of changes. In the early 1980’s several underwriters left the market after getting severely hurt by the “Hi-yield” bond craze, among other things like the S&L crises, etc. The mid 1980’s brought a “hard market” where capacity shrunk while premiums and retentions multiplied.

Today we face a “challenging” time, especially for Public D&O Insurance. Many believe this market could last for 2 – 3 years. Almost everyone agrees it will be years before we fully understand the impact of Enron, Worldcom, Adelphia, etc.

When evaluating Public D&O Liability Insurance, one could break it down in the following general categories:

Fiduciary Duties

There are three basic fiduciary duties of corporate directors: duty of diligence, duty of loyalty and duty of obedience.

Duty of diligence is an important and chief obligation of corporate directors, and requires the directors serve in the “best interest of the corporation” and to “act” as a “prudent person”.

Duty of loyalty requires a director not to use his/her capacity for personal gain of benefit. This requires that here is no conflict of interest or taking advantage by diverting real or potential profit from the corporation to obtain personal gain.

The duty of obedience requires that directors follow the powers provided to them through the corporation’s by-laws, charter and articles of incorporation.

Federal, State and Local Laws

Historical D&O claims statistics show that the greatest frequency of claims arise out of alleged violations of federal securities laws. Specifically, The Securities Act of 1933, and The Securities Act of 1934.

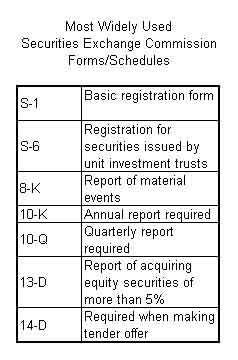

Under The Securities Act of 1933, Section II, liability can be imposed when a registration statement (S-1) contains misleading, omissions or untrue “material fact”. Under this section the liability extends to the entity itself, every person who signed the registration statement, every director at the time of signing, and etc.

The Securities Act of 1933 provides for the registration of securities which are to be sold to the public so that complete information is available to all interested parties. Keep in mind the “securities” has a broad definition that includes: stocks, bonds (debt), notes, convertible debentures, warrants…

Once a company is public, they fall under the requirements of The Securities Exchange Act of 1934. This law governs the operation of stock exchanges and over the counter trading. It’s chief power is the requirement of publication of information concerning the securities listed on an exchange in a fair and timely manner.

A frequent allegation is violation of The Securities Exchange Act of 1934/Rule 10(b)5. Rule 10(b)5 states that it is unlawful for any person to manipulate in anyway the purchase and/or sale of securities. The rule states it unlawful to:

“Make any untrue statement of a material fact

or to omit to state a material fact necessary

in order to make the statement…not misleading”.

Private Securities Litigation Reform Act of 1995 (PSLRA)

PSLRA was passed in late 1995 when Congress overrode Clinton’s veto. Initially it was thought that this legislation would stop the abuses of some plaintiffs and their attorneys.

It was written to alter the way in which and by whom could bring securities litigation against the company’s directors and officers. It also set up “Safe Harbor” provisions.

Initially, federal securities litigation decreased. Many believe it was a result of the plaintiffs’ bar analyzing the new legislation and allowing for a “cooling” period. In hindsight, the number of securities class actions post PSLRA has greatly increased. Obviously, this is due to numerous factors.

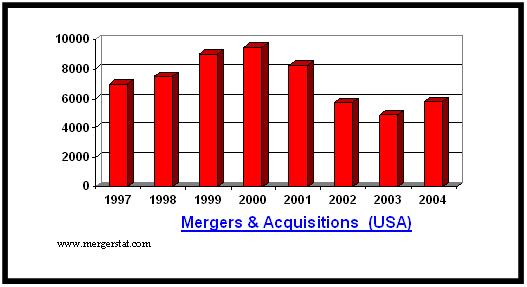

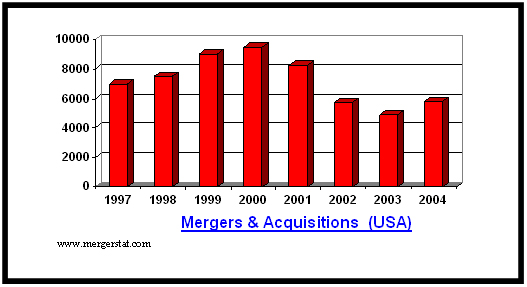

Mergers & Acquisitions (M&A)

In 1985 the now famous Delaware Supreme Court decision, Smith V. Van Gorkom changed the M&A exposure of directors forever. The case involved the acquisition of Trans Union by Marmon. The basics of the case involved Trans Union’s directors approving the sale without adequate due diligence taking place. This “new” standard of due diligence has become a major concern/exposure for both the acquirer and acquiree and extends beyond only the selling price. Concern for the employees, environmental, pension/retirement, communities are all issues when evaluating due diligence.

Private Directors’ & Officers’ Liability Insurance (Management Liability)

A private corporation is a legal entity created through the laws of its state of incorporation. Private companies do NOT fall under the laws and reporting requirements of the Securities Exchange Commission. Individual states have the power to promulgate laws relating to the creation, organization and dissolution of corporations. Many states follow the Model Business Corporation Act.

State corporation laws require articles of incorporation to document the corporation’s creation and to provide provisions regarding the management of internal affairs. Within the articles of corporation, the indemnification provision allows for the company to indemnify its directors, officers, and sometimes employees when permitted by law.

The law treats a corporation as a legal “person” that has the ability to sue and be sued. The legal independence of a corporation prevents shareholders from being personally liable for corporate debts. It also allows stockholders to sue the corporation through a derivative suit.

Private companies have been sued by its constituents, including but not limited to stockholders (equity and/or debt), employees (past, present and prospective), clients, competitors, advocacy groups, and city/state/federal regulatory agencies. Although private companies litigation traditionally has not been as costly as public companies’ litigation, frequency in recent years has increased. Allegations include:

| Age Discrimination | Breach of Duty |

| Disability Discrimination | Error |

| Failure to Hire | Invasion of Privacy |

| Misleading Statements | Misstatement |

| National Origin Discrimination | Neglect |

| Omission | Pregnancy Discrimination |

| Racial Discrimination | Retaliation |

| Sexual Harassment | Sexual Orientation Discrimination |

| Wrongful Demotion | Wrongful Termination |

NON-PROFIT DIRECTORS’ & OFFICERS’ LIABILITY INSURANCE

A non-profit organization is organized for purposes other than generating profit and in which no part of the organization’s income is distributed to its members, directors, or officers. Non-profit organizations include churches, public schools, public charities, public clinics and hospitals, political organizations, legal aid societies, volunteer services organizations, professional associations, research institutes, museums, and some governmental agencies. Non-profit organizations must be designated as nonprofit when created and may only pursue purposes permitted by statutes for non-profit organizations.

Non-profit entities are organized under state law. Some states exempt non-profit organizations from state tax and state employment programs such as unemployment compensation contribution.

Some states make distinctions between organizations not operated for profit without charitable goals (like a sports or professional association) and charitable associations in order to determine what legal privileges the respective organizations will be given.

For federal tax purposes, an organization is exempt from taxation if it is organized and operated exclusively for religious, charitable, scientific, public safety, literary, educational, prevention of cruelty to children or animals, and/or to develop national or international sports.

ExecutivePerils is appointed with over 20 markets that offer non-profit D&O insurance. Although each policy is different, we seek to offer our client coverage that includes:

- Coverage for all past, present, and future directors, officers, trustees, and employees, including staff, volunteers, and committee members.

- Entity coverage built-in. Coverage for claims made against the organization itself.

- Employment Practices Liability coverage. Protect all insured persons of the organization against damages from claims for wrongful termination, sexual harassment, discrimination, unfair hiring/firing practices, mental anguish, and emotional distress.

- Duty to Defend.

- Defense expenses outside the limits of liability. Defense expenses incurred will not diminish the limit available under the policy.

- Personal injury. Coverage for libel, slander, defamation of character, invasion of privacy, and infringement of copyright, trade mark, plagiarism, or misappropriation of ideas.

- Prior acts coverage. Coverage for unknown prior wrongful acts.

- Broad extended reporting period option. Including bilateral and multi-year.

- Fiduciary liability insurance coverage available by endorsement.

Our diversified portfolio of non-profit policyholders range from $500,000 to $50 million in limits. We welcome an opportunity to assist you with all your non-profit D&O insurance needs.

GENERAL PARTNERSHIP LIABILITY INSURANCE

In a Limited Partnership, one or more ‘general” partners manage the business while “limited” partners contribute capital and share in the profits but take no part in running the business. General partners remain personally liable for partnership debts while limited partners incur no liability with respect to partnership obligations beyond their capital contributions. Limited partners are not personally responsible for liability for debts of the partnership where as the general partners are liable. In exchange for this limited liability, a limited partner may not participate in the management of the business. If a limited partner does choose to become actively involved in the management of the business, he risks losing the immunity from personal liability and in essence becomes as legally responsible as a general partner.

An advantage of choosing a general partnership as a business structure is that it provides a way for a business to raise money, by taking on limited partners, while allowing the partners to retain the power of management within the business.

REAL ESTATE INVESTMENT TRUSTS (REITs)

A Real Estate Investment Trust (REIT) is a company dedicated to owning and, in most cases operating income-producing real estate, such as apartments, golf courses shopping centers, and office buildings.

In 1960 Congress created Real Estate Investment Trusts (REITs). However, for nearly 30 years REITs played a modest role among real estate investment activities. Since the early 1990’s REITs have grown tremendously due to the interest in diversifying investments while capitalizing on tax advantages.

The Tax Reform Act of 1986 radically changed the real estate investment playing field in two important ways. First, the Act greatly reduced the potential of real estate investments to generate tax shelter opportunities. Because the Act limited interest deductions, increasing the length of depreciation periods and restricted the use of “passive losses.” Because of this real estate investments had to be long term and income orientated.

The second part of the Act ‘invented’ the Real Estate Investment Trust (REIT). The Act permitted REITs to own, operate and manage, most types of income-producing commercial properties. REITs have numerous tax advantages granted by Congress. The chief advantage is the ability to deduct the dividends paid to shareholders from its corporate tax bill so long as certain conditions exist. They are:

- the company’s income is mainly derived from real estate,

- the company pays out at least 90 percent of its taxable income to shareholders and,

- the company’s assets are primarily composed of real estate held for the long term.

Even with these changes, REITs did not flourish right away. It was not until foreign investors, insurance companies and pension funds (along with the S&L crises) slowed their real estate financing that the real estate investing community looked to Real Estate Investment Trusts as a viable alternative.

REITs, similar to public companies, are carefully monitored by others, including the Securities Exchange Commission and have public filing requirements.

ExecutivePerils has a national recognized expertise in the placement of Real Estate Investment Trust’s E&O/D&O policies. Our portfolio of REITs include both public and private clients. We understand the unique exposures and have underwriters that recognize the unique aspects and have the ability to underwrite these companies. We currently can provide policies with limits up to $50,000,000. Any ExecutivePerils broker would be happy to walk you and/or your prospective client through this coverage and marketing process.

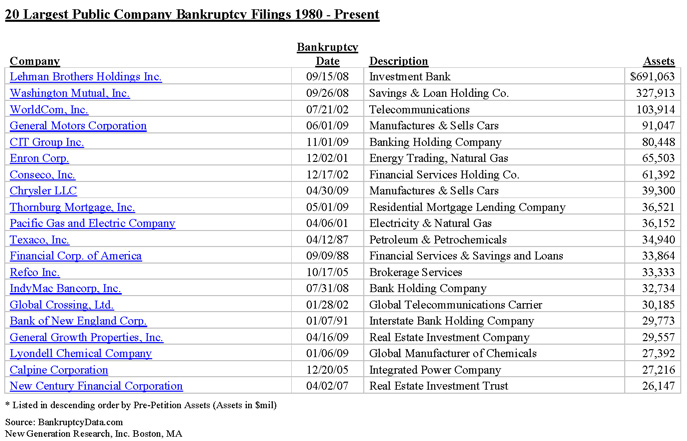

MERGERS & ACQUISITIONS / BANKRUPTCY RUN-OFF

Bankruptcy law provides for the development of a plan that allows a debtor, who is unable to pay his creditors, to resolve his debts through the division of his assets among his creditors. This supervised division also allows the interests of all creditors to be treated with some measure of equality. Certain bankruptcy proceedings allow a debtor to stay in business and use revenue generated to resolve his or her debts. An additional purpose of bankruptcy law is to allow certain debtors to free themselves (to be discharged) of the financial obligations they have accumulated, after their assets are distributed, even if their debts have not been paid in full.

Bankruptcy law is federal statutory law contained in Title 11 of the United States Code. Congress passed the Bankruptcy Code under its Constitutional grant of authority to “establish. . . uniform laws on the subject of Bankruptcy throughout the United States.” See U.S. Constitution Article I, Section 8. States may not regulate bankruptcy though they may pass laws that govern other aspects of the debtor-creditor relationship. See Debtor-Creditor. A number of sections of Title 11 incorporate the debtor-creditor law of the individual states.

Bankruptcy proceedings are supervised by and litigated in the United States Bankruptcy Courts. These courts are a part of the District Courts of The United States. The United States Trustees were established by Congress to handle many of the supervisory and administrative duties of bankruptcy proceedings. Proceedings in bankruptcy courts are governed by the Bankruptcy Rules which were promulgated by the Supreme Court under the authority of Congress.

There are two basic types of Bankruptcy proceedings. A filing under Chapter 7 is called liquidation. It is the most common type of bankruptcy proceeding. Liquidation involves the appointment of a trustee who collects the non-exempt property of the debtor, sells it and distributes the proceeds to the creditors. Bankruptcy proceedings under Chapters 11, 12, and 13 involves the rehabilitation of the debtor to allow him or her to use future earnings to pay off creditors. Under Chapter 7, 12, 13, and some 11 proceedings, a trustee is appointed to supervise the assets of the debtor. A bankruptcy proceeding can either be entered into voluntarily by a debtor or initiated by creditors. After a bankruptcy proceeding is filed, creditors, for the most part, may not seek to collect their debts outside of the proceeding. The debtor is not allowed to transfer property that has been declared part of the estate subject to proceedings. Furthermore, certain pre-proceeding transfers of property, secured interests, and liens may be delayed or invalidated. Various provisions of the Bankruptcy Code also establish the priority of creditors’ interests.

ExecutivePerils has carved out an expertise in placing both Trustee Errors & Omissions insurance and ‘tail’ coverage (Run- Off) for companies that have entered bankruptcy. Our portfolio of D&O “tail/ run-off” includes many companies that once had household names. We understand the unique exposures and have underwriters that recognize the unique aspects and have the ability to underwrite these companies. We currently can provide policies up to ten (10) years although most purchase six (6) years. Any ExecutivePerils broker would be happy to walk you and/or your prospective client through the advantages (and necessity) of having this valuable coverage.

Application

Contact Us